Pesticide tax in the EU

Various levy concepts and their impact on pesticide reduction

Personnel

Department of Environmental and Planning Law

Dr. Stefan Möckel (Lead)

Department of Economics

Prof. Dr. Erik Gawel

Department of System-Ecotoxicology

Prof. Dr. Matthias Liess

Pesticide Expert

Lars Neumeister

Duration

03/2021 − 09/2021

Status

The study was commissioned by: Aurelia Stiftung, BioBoden Genossenschaft eG, Bioland e.V., Bündnis für eine enkeltaugliche Landwirtschaft e.V., Deutsche Umwelthilfe e.V., Foodwatch e.V., GLS Bank, GLS Bank Stiftung, GLS Treuhand – Zukunftsstiftung Landwirtschaft, Greenpeace e.V., Pestizid Aktions‐Netzwerk e.V. (PAN Germany), Soil & More Impacts GmbH, WWF Deutschland.

Publications

Description

Under the Green Deal, the European Commission wants to halve both the use and risk of chemical pesticides as well as the use of higher-risk pesticides by 2030. The introduction of a risk-based levy on all chemical plant protection products at the European level would allow to achieve this objectives and promote integrated pest management.

In our study, we compare different concepts for a levy on pesticides and analyse in particular developments in Denmark, where a risk-based pesticide tax was introduced in 2013. Taking Germany as an example (see German study), we use a dynamic database approach to simulate the different steering effects of the various levy concepts in order to estimate how different levies would change pesticide use in terms of quantity, treatable area, and risks. The simulation and the experience with the Danish tax show that a levy on plant protection products should be linked to the maximum permissible application dose per hectare and year (vegetation period) specified in the authorisation for each product due to the application dose can vary up to a thousandfold due to the different efficacy of the respective active substances.

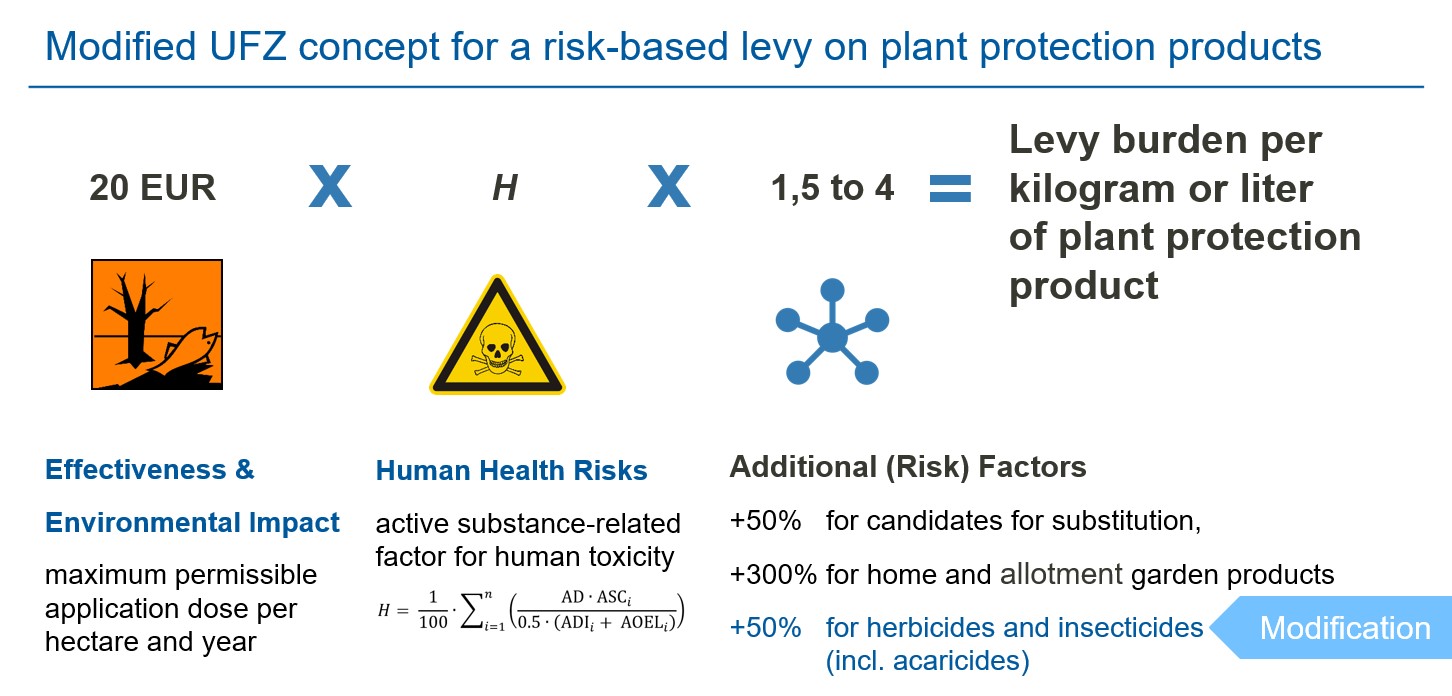

A levy concept that takes these immense differences into account was proposed by the UFZ in 2015 and is developed further in this study. We suggests a basic levy rate of 20 EUR for the maximum permissible application dose per hectare and year, which is then multiplied by a risk-based factor for the human toxicity of the active substances contained and by further additional factors for substitution candidates, home and small garden products, herbicides and insecticides (see Figure 1).

Note: The exact formula for the UFZ concept is presented in Chapter 5.4 of the study, including the calculation of the human toxicological factor and the conversion of the levy burden per kilogram or liter of plant protection product into a percentage price surcharge. The modification made 2021 is explained in detail in Chapter 5.5.

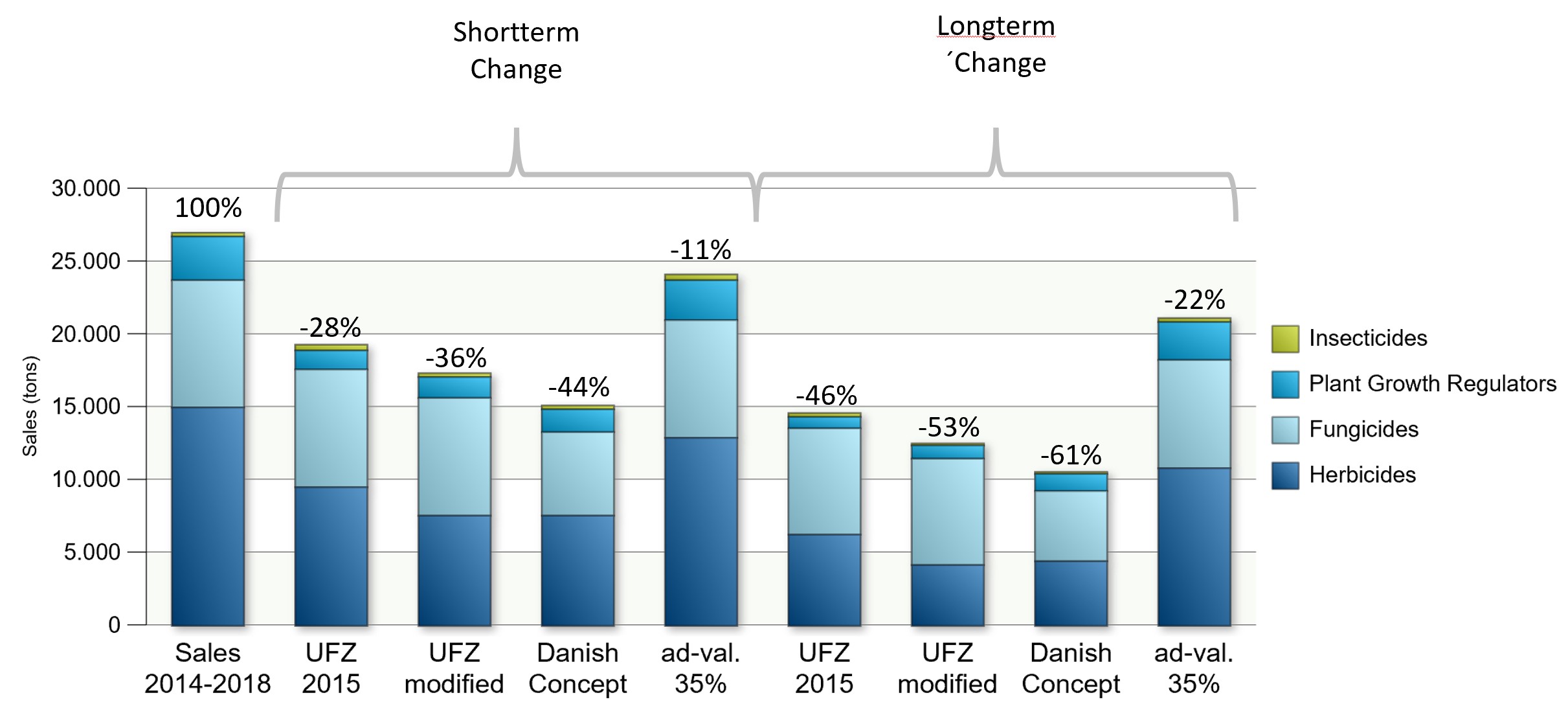

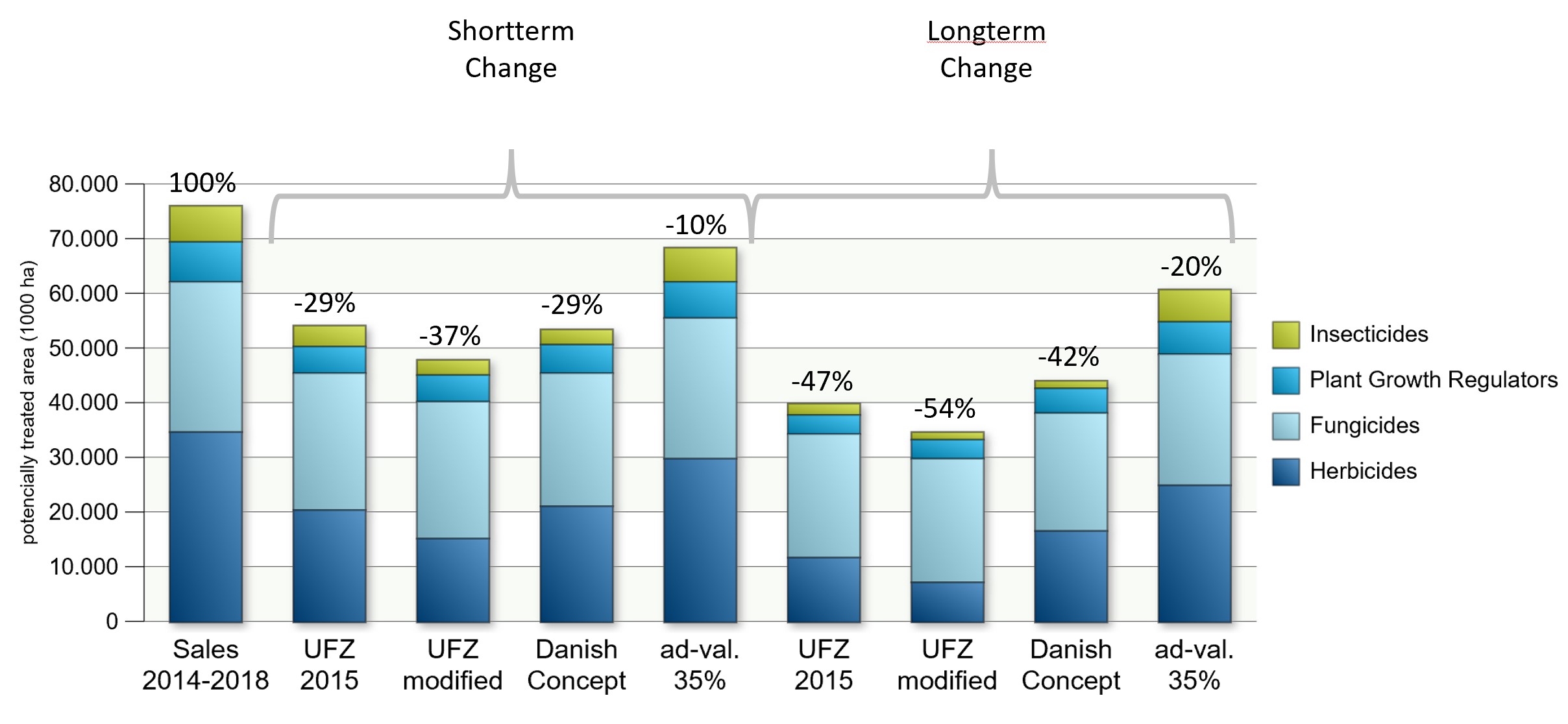

Due to the emphasis on maximum permissible application doses, in the simulation carried out for Germany this levy concept reduced the potentially treatable total area1 much more than the Danish concept, although in the model the latter reduces more the total quantity of active substances applied (compare Figure 2 and 3). The improvement for humans and the environment is therefore higher with the maximum permissible application dose as reference point than with a tax that rests merely on a risk-based kilogram or litre assessment of active substances, as in Denmark, where users of high-dose pesticides switch to high-efficacy pesticides with smaller application quantities and lower tax burden.

The results of the simulation and the derived recommendations can be applied to other Member States and the EU as a whole. For the English version of the study presented here, we additionally analysed the possibility of the EU's legal competences to introduce a Europe-wide taxation of pesticides. Based on the Treaty on the Functioning of the European Union (TFEU), the European Union can introduce a risk-based levy on plant protection products either as its own levy or as a member state obligation to introduce corresponding national levies. The levy could be introduced as a tax paid into the EU or national budgets, or as a non-tax levy, the revenue from which would be allocated to a special fund at the European or national level.

Explanation: The left column (Sales 2014-2018) represents the averaged actual sales in Germany in the years 2014 to 2018. The following columns display the results of the modelling for the four levy concepts examined with an assumed price elasticity of –0.2 for short-term and –0.4 for long-term steering effects of a price increase (further information can be found in Chapter 6 of the study).

1 This is the area that could be treated with the current or estimated sales volume of all active substances for each levy concept, if the maximum permissible application dose per hectare and year were exhausted (see Chapter 2.1of the study).